The issuer has filed a registration statement, and a final prospectus, with the SEC for the offering to which this communication relates (file no. 333-213166). Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR or the SEC web site at www.sec.gov. Alternatively, the issuer, any underwriter or dealer participating in the offering will arrange to send you the prospectus if you request it by contacting Network 1 Financial Securities, Inc., Attention: Keith Testaverde, by telephone at 800-886-7007.

To review a filed copy of our current registration statement, click on the following link:

https://www.sec.gov/Archives/edgar/data/1674227/000114420416122126/v447872_s1a.htm

To review a filed copy of our final prospectus, click on the following link:

https://www.sec.gov/Archives/edgar/data/1674227/000114420416122666/v448288_424b1.htm

Initial Public Offering Proposed Nasdaq Ticker: AMMA September 2016 Filed Pursuant to Rule 433 of the Securities Act Issuer Free Writing Prospectus dated September 20, 2016 Relating to Final Prospectus dated September 2, 2016 Registration No. 333 - 213166

www.alliancemma.com 2 Alliance MMA, Inc . has filed a registration statement, and a final prospectus, with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates . Before you invest, you should read the final prospectus and that registration statement and other documents we have filed with the SEC for more complete information about us and this offering . You may obtain these documents for free by visiting EDGAR on the SEC’s website at www . sec . gov . Alternatively, you may obtain copies of the final prospectus by contacting Network 1 Financial Securities, Inc . , Attention : Keith Testaverde, by telephone at 800 - 886 - 7007 or by mail at 2 Bridge Avenue, Suite 241 , Red Bank, NJ 07701 . All statements contained herein other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward looking statements . The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” and similar expressions are intended to identify forward looking statements . We have based these forward - looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short - term and long - term business operations and objectives, and financial needs . These forward - looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the “Risk Factors” section of the prospectus . Moreover, we operate in a very competitive and rapidly changing environment . New risks emerge from time to time . It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statements we may make . In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied on the forward looking statements . Company Disclaimer

Offering Summary www.alliancemma.com 3 Issuer Alliance MMA, Inc. Security Common Stock NASDAQ Ticker AMMA Shares Outstanding After Completion of the Offering 7,777,778 - 10,000,000 Shares Offered 1,111,111 - 3,333,333 Price $4.50 per share Use of Proceeds Acquisition of promotions, capital expenditures to support and enhance operations, and general working capital including marketing Management Lock-Up 6 months Underwriter Network 1 Financial Securities Expected Closing Date 29-Sep-16

www.alliancemma.com 4 Who We Are Alliance MMA intends to create the premier promotional showcase for aspiring mixed martial arts (MMA) fighters to advance to the sport’s highest level of professional competition . We expect to achieve our goal by acquiring successful regional promotions and, in order to expand our MMA fan base, by acquiring and developing a world - class media production and distribution operation, as well as an electronic ticketing platform .

• MMA is a full contact sport that permits fighters to use techniques from both striking and grappling martial arts such as Boxing, Wrestling, Taekwondo, Karate, Brazilian jiu - jitsu, Muay Thai, and Judo. • Professional MMA fights are legal and regulated by athletic commissions in all 50 states. • Interest and participation in the sport is growing at a rapid pace - over 1,160 professional and pro - am events were held in the United States in 2014, and over 3,050 such events were held in 2015. According to the National MMA Registry, in 2015 there were a total of 15,105 professional MMA bouts and 12,190 amateur bouts. • Led by the UFC in terms of prominence and market share domestically, there are in excess of 600 domestic regional MMA promotion companies promoting approximately 40,000 male and female professional and amateur fighters. Internationally, the number of MMA promotions exceeds 1,025, with in excess of 90,000 professional and amateur MMA fighters. • According to the UFC website, live MMA events are currently televised in over 129 countries and territories in approximately 800 million households in 28 languages. Industry Overview www.alliancemma.com 5

Alliance MMA intends to acquire and combine five leading regional MMA promotions (the “Target Companies”), along with certain MMA media libraries and distribution platforms (the “Target Assets”), and plans to acquire additional regional promotions. Going forward: • We intend to enhance the collective market share and profitability of the businesses of the Target Companies through increased ticket sales, incremental events, centralization of certain common business functions, and the application of best business practices • We will strive to produce a highly - organized showcase event conduit to become the premier feeder organization to the UFC, Bellator MMA, World Series of Fighting, and other prestigious MMA promotions worldwide • We plan to invest so as to expand the quantity and quality of our live video production and content distribution assets which currently include a media library of 10,000 hours of early career bouts of MMA icons • We anticipate expanding the customer base of the MMA industry’s leading electronic ticketing platform operation through enhancements in software technology Our Objectives www.alliancemma.com 6

Our Strategy www.alliancemma.com 7 Over the next 12 months, we intend to: • Acquire additional regional MMA promotions in order to develop national sponsorship arrangements, and expand existing regional sponsorship arrangements, in support of the Company’s network of live MMA events • Leverage the Target Assets and the existing media libraries of the Target Companies, along with the production of new, original live MMA programming created at our ongoing professional MMA events, and monetize both through domestic and international distribution arrangements • Increase historic revenue by expanding the average annual number of events for each promotion, and through the application of best business practices, including economies of scale associated with centralizing common business functions, as well as migrating certain promotions from paid event venue arrangements to venues that will compensate the promotions for hosting events • Aggregate control of the sales chain through ownership of CageTix, and instituting the use of CageTix across all the Target Companies, potentially capturing additional profit margin and valuable customer data analytics • Secure highly - regarded professional fighters to multi - fight agreements, which will enhance our reputation and the value of our live MMA programming content through domestic and international distribution arrangements

www.alliancemma.com 8 Target Companies Hoosier Fight Club Cage Fury Fighting Championships Combat Games MMA Shogun Fights V3 Fights GoFightLive CageTix * (click the logos)

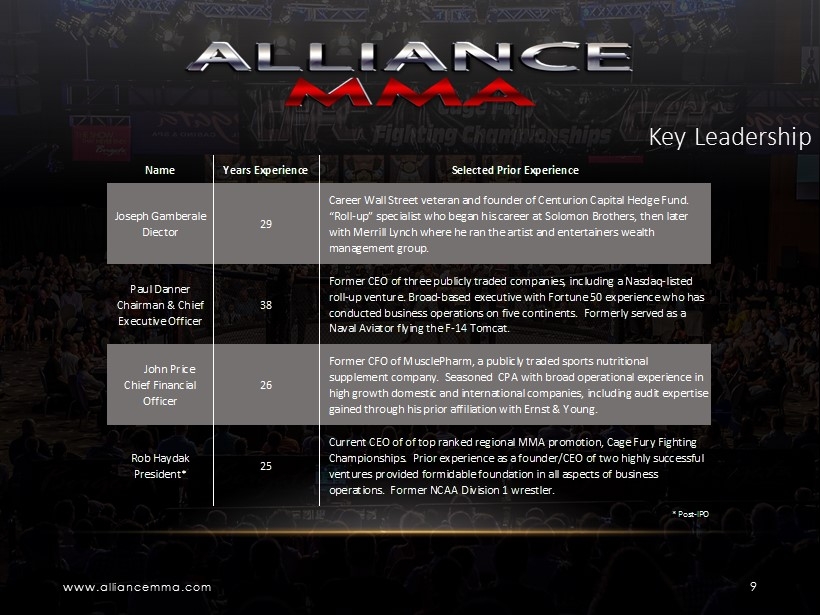

Key Leadership www.alliancemma.com 9 Name Years Experience Selected Prior Experience Joseph Gamberale Diector 29 Career Wall Street veteran and founder of Centurion Capital Hedge Fund. “Roll-up” specialist who began his career at Solomon Brothers, then later with Merrill Lynch where he ran the artist and entertainers wealth management group. Paul Danner Chairman & Chief Executive Officer 38 Former CEO of three publicly traded companies, including a Nasdaq-listed roll-up venture. Broad-based executive with Fortune 50 experience who has conducted business operations on five continents. Formerly served as a Naval Aviator flying the F-14 Tomcat. John Price Chief Financial Officer 26 Former CFO of MusclePharm, a publicly traded sports nutritional supplement company. Seasoned CPA with broad operational experience in high growth domestic and international companies, including audit expertise gained through his prior affiliation with Ernst & Young. Rob Haydak President* 25 Current CEO of of top ranked regional MMA promotion, Cage Fury Fighting Championships. Prior experience as a founder/CEO of two highly successful ventures provided formidable foundation in all aspects of business operations. Former NCAA Division 1 wrestler. * Post-IPO

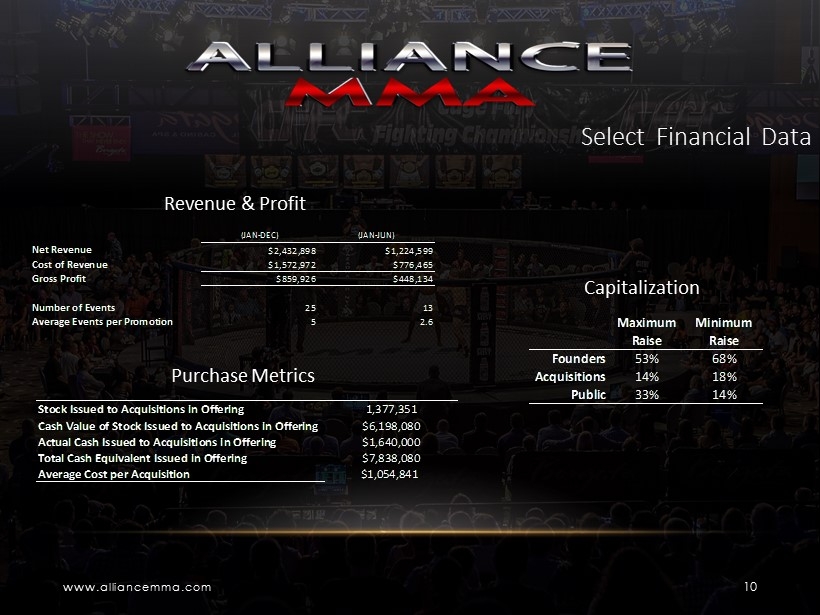

Select Financial Data www.alliancemma.com 10 Revenue & Profit (JAN-DEC) (JAN-JUN) Net Revenue $2,432,898 $1,224,599 Cost of Revenue $1,572,972 $776,465 Gross Profit $859,926 $448,134 Number of Events 25 13 Average Events per Promotion 5 2.6 Purchase Metrics Stock Issued to Acquisitions in Offering 1,377,351 Cash Value of Stock Issued to Acquisitions in Offering $6,198,080 Actual Cash Issued to Acquisitions in Offering $1,640,000 Total Cash Equivalent Issued in Offering $7,838,080 Average Cost per Acquisition $1,054,841 Maximum Raise Minimum Raise Founders 53% 68% Acquisitions 14% 18% Public 33% 14% Capitalization

• By expanding the average number of historic events held by the Target Companies and through additional acquisitions, we expect over the next 12 months, to create a well - orchestrated family of 15+ domestic and international promotions that we anticipate will produce 125+ professional MMA events per year, with 200+ fighters under contract • Once our expansion is in place, we intend to leverage our national market presence to secure multiple sponsorship arrangements with a number of prominent consumer name brands • Through investment in equipment and technology, we plan to transform our production and media distribution and electronic ticketing platforms into industry - recognized, world - class operations • We anticipate leveraging the Target Assets and the existing MMA fight media libraries of the Target Companies, and well as producing original MMA programming, in order to enter into domestic and international distribution arrangements including broadcast television, internet streaming, pay per view, subscription and other means • By standardizing and streamlining event operations, and through efficiencies gained by centralizing certain common business processes as well as the application of best business practices, we expect to improve the financial performance of all our events Why Invest in AMMA www.alliancemma.com 11

Contact www.alliancemma.com 12 Keith Testaverde Network 1 Financial Securities, Inc. 2 Bridge Avenue, Building 2 Red Bank, NJ 07701 (732) 758 - 9001 ktestaverde@netw1.com